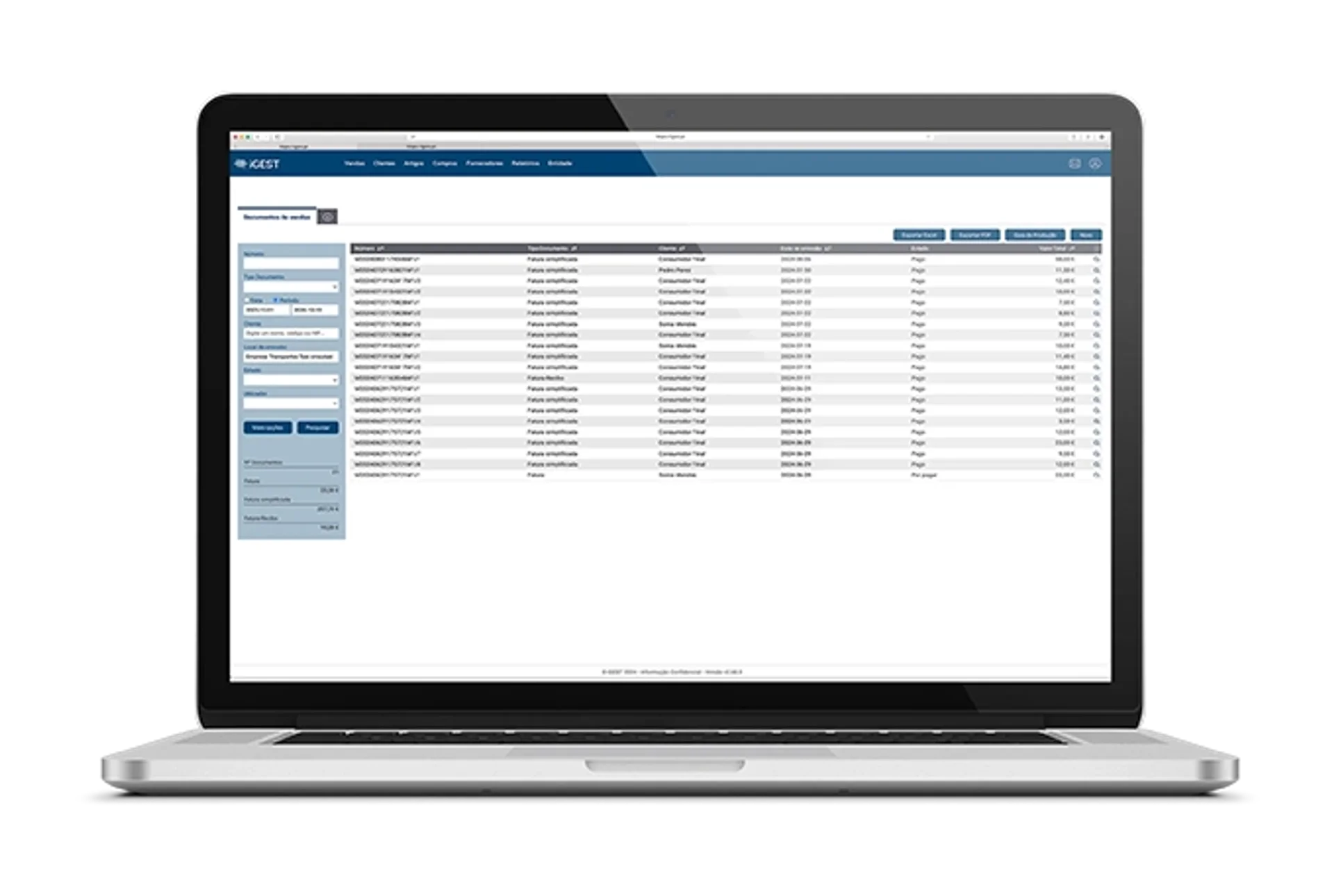

Issuance of Invoicing Documents

Issuance of all the documents your company needs, easily and intuitively, in compliance with the law.

The issuance of Invoicing Documents is a crucial process for any business, regardless of its size or nature. These documents include Invoices, Receipts, Credit and Debit Notes, Delivery Notes, among others.

What guarantees the correct issuance of these documents?

Legal Compliance – Ensures that your company is in compliance with the legal obligations, preventing legal issues and sanctions;

Financial Control - Allows you to keep an organised record of business transactions, facilitating control and subsequent decision-making;

Credibility - Credible and professional invoicing documents build trust with customers and suppliers, strengthening their relationship with the company.

The issuance of Invoicing Documents is a crucial process for companies, self-employed professionals and sole proprietors. Basically, anyone who provides services or sells goods or products is obliged to issue invoicing documents.

iGEST allows unlimited issuance of the following:

Invoice and Receipt – An Invoice is a record of service provision or goods transfer and must be issued when there is no immediate payment, which will be settled upon receipt issuance. Thus, Receipts confirm the payment of an invoice.

Simplified Invoice – Refers to a document issued at the time of immediate payment, meaning it is settled and intended for the end consumer. It must be issued at the time of service/product acquisition, without requiring details such as Tax ID or name. It has a value limit imposed by law: €1,000 for retailers and €100 for other activities.

Proforma Invoice – A purely informational document on agreed amounts, without fiscal validity. However, it must be reported to the Tax Authority (AT). It is typically requested for goods orders and used to analyze and approve purchases. It is mainly required for goods transfer in international trade, as it is considered a customs justification.

Credit and Debit Notes – A Credit Note is a legal document for account adjustments to correct Invoices partially or entirely. A Debit Note is issued to correct VAT-related issues in an invoice, requiring the issuance of a new Invoice.

In summary, these two types of documents aim to correct previously issued invoices for different purposes.

Consignment/Transport Guide – The Consignment Guide refers to the shipment of goods, while the Transport Guide accompanies the movement within national territory of goods subject to VAT-related operations (excluding exceptions under Article 3 of the Goods Circulation Regime).

According to the Tax Authority, Circulating Goods include materials leaving production or transformation sites or on display in commercial establishments.

What are the required elements in Transport Documents?

Article 4 of the Goods Circulation Regime mandates the following elements:

Global Guide – It is a transport document issued when the recipient of the goods is not known at the time of their departure.

It requires the issuance of a document of effective delivery of the goods to the recipient or, in the case of goods to be incorporated into services provided by the sender, the registration in a specific document (work order or equivalent document).

Global Guides require communication to the Tax Authority (AT) before the transport of goods or merchandise is carried out, as this is the only way to obtain the transport code. It is also mandatory, in addition to this code, to have the printed Global Guide at the time of transportation.

Bill of Lading - This is a transport document issued when the goods are in circulation that have not yet been sold and are therefore on consignment. It must be issued with VAT and communicated within 5 working days from the moment the products are sent on consignment.

Work Sheet – This document, used in Civil Construction, is essential for project and work management, as it records all relevant information related to the work, such as allocated resources, project description, incidents, approvals/licenses, among others.

Budget – Although similar to the Proforma Invoice, it is used to estimate services.

In addition to these Billing Documents, iGEST also allows the issuance of Delivery Notes and Disposal Guides.

We provide everything you need for invoicing in a single software. Be the Protagonist of your Invoicing!