Invoicing Tax Obligations

The business environment is currently undergoing a period of technological transformation never before seen in history. As a result of this evolution, tax systems and procedures must adapt to this accelerated development, with the primary goal of simplifying administrative processes and reducing the high complexity of tax obligations that characterize the Portuguese tax system.

Additionally, the implementation of digital solutions represents a significant commitment to environmentally sustainable practices by greatly reducing the consumption of printed materials, while also serving as a fundamental tool in the collective effort to prevent and detect tax evasion practices.

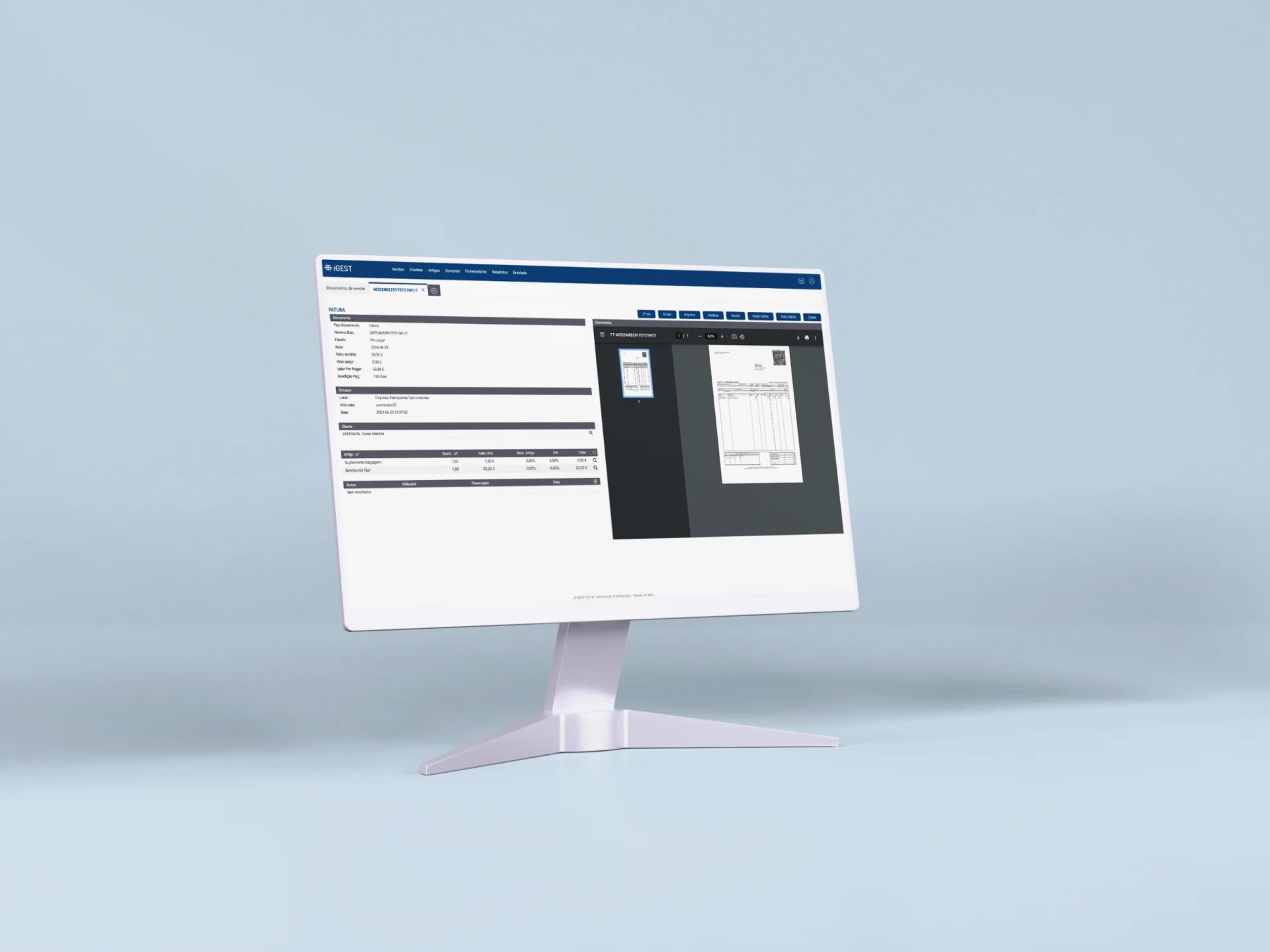

By using the iGEST software system — an invoicing solution officially certified by the Portuguese Tax and Customs Authority, as evidenced by certification number one thousand four hundred and eighty — your organization will have continuous access to the latest updates to the applicable legal framework, thus ensuring full compliance with all obligations and requirements established by current legislation.