Invoicing Software

Frequently Asked Questions about iGEST Invoicing Software

Invoicing Software

(16 questions)

(12 questions)

(15 questions)

(17 questions)

A Point of Sale - POS is a system or location where the commercial transaction between a customer and a seller is recorded. It was formerly known as a cash register and refers to the physical or virtual point where the customer makes payment for products and/or services purchased. Generally, it refers to a hardware and software system that allows the vendor to record the purchase, calculate the amount to be paid, process the payment and print a receipt for the customer.

For the restaurant sector, you can configure the number of tables and manage your orders, with automatic receipt printing. The application provides complete user autonomy, thus ensuring quality service.

Designed for businesses that need to manage their points of sale quickly and flexibly, iGEST can be used while maintaining your current POS terminal:

- Through installation on the POS terminal, for Windows, Linux and OS X operating systems, without requiring internet connection;

- On Android tablet for POS (with or without internet);

- On mobile phone, through the app (with or without internet);

- From your computer (includes advanced settings).

An invoice is a document that must be issued whenever there is a transfer of goods or provision of services. The difference between these two documents is that simplified invoices do not require names, company names or corporate names, headquarters or address of the purchaser, and tax identification numbers of non-taxable persons, unless they request it.

Note: simplified invoices can only be issued up to €1,000 for goods transfers made by retailers or street vendors to non-taxable persons, and up to €100 for other transfers of goods and services.

These are rectifying documents used when you've made a mistake in the amount invoiced to your client. You can issue a credit or debit note for the total or partial difference, always referencing the original invoice number.

Credit Notes are used to rectify the partial or total difference if you made a mistake in the amount charged to your client when issuing the invoice. If the invoice has a higher amount than what was billed, you'll need to issue a new invoice.

Debit Notes are used to make adjustments, particularly to the invoiced amount, when it was issued with incorrect VAT.

A global transport document is a document issued when the recipient of the goods is not known at the time of departure of the goods. The issuance of the global transport document requires the issuance of a document of effective delivery of the goods to the recipient or, in the case of goods to be incorporated into services provided by the sender, the registration in a specific document (work sheet or equivalent document).

The Tax Authority defines circulating goods as all materials that are outside the places of production, manufacture, transformation, exhibition or sales establishments. All goods found in vehicles during unloading or transshipment, as well as goods displayed for sale at fairs and markets.

iGEST is adapted to any type of business or professional situation. The POS version consists of a system that can be at the point of sale, which responds, for example, to the needs of a café, restaurant, or hotel, where you can pre-define the products you sell and their prices.

In the tablet version, your POS is no longer fixed, static, and only in one place. You can use the POS environment from your Android tablet, being able to invoice without having to acquire a cash register, move to the cash register, or be prevented from invoicing at the same time as your colleagues.

If you prefer your POS to be fixed, you can use your computer or the appropriate equipment for this purpose.

With iGEST you can issue: Invoices, Receipts, Simplified Invoices, Credit Notes, Debit Notes, Transport Guides, Global Transport Guides, Consignment Notes, Work Sheets, Delivery Notes, Write-off Notes, Recipe Delivery Notes, Proforma Invoices and Quotes.

Yes. The mobile application available on Google Play and the App Store adapts to mobile device screen dimensions, whether it's a smartphone or tablet.

Quotes and Proforma Invoices differ in the type of product - a quote presents a value proposal for service provision, while a Proforma Invoice presents a proposal for companies that sell goods.

Taxpayers can opt for this regime through the following issuance methods:

- Electronically;

- By software certified by the TA;

- By software produced internally by the company or group (whose copyright is held);

- Through the Finance Portal;

- On paper, using authorized typography prints.

There is no difference in content between the transport document, the delivery note or other documents equivalent to them, and they can be used in accordance with commercial practice. The Transport Guide is a document accompanying the movement, within national territory, of goods which may be the subject of transactions carried out by VAT taxable persons (without prejudice to the appropriate exclusions provided for in Article 3 of the Regime for Goods in Circulation). Any such document is a transport document if it contains the elements referred to in Article 4 of the Regime for Goods in Circulation.

*Maximum price per minute: 0,09€ (+VAT) for calls originating from fixed networks and 0,13€ (+VAT) for calls originating from mobile networks.

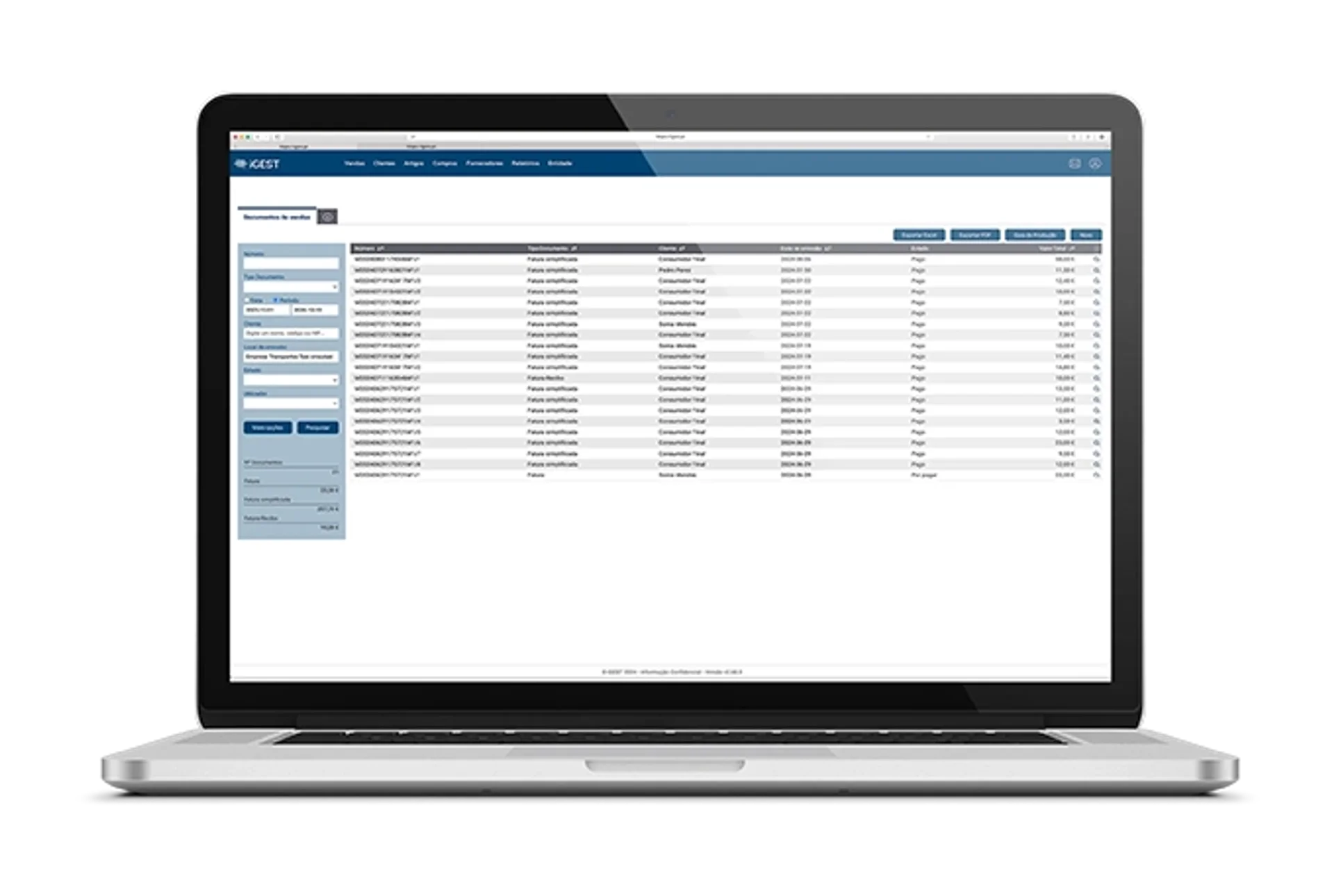

iGEST is an intuitive Invoicing Software that allows you to quickly and efficiently manage all the daily commercial and invoicing activities of a company. Our software allows you to issue invoices, receipts and delivery notes, as well as manage your stocks, warehouses, customers, purchases and sales. Enjoy it for free during 30 days!