Invoicing Software

Frequently Asked Questions about iGEST Invoicing Software

Invoicing Software

(16 questions)

(12 questions)

(15 questions)

(17 questions)

According to Decree-Law No. 198/2012, published on August 24, economic agents are required to communicate the elements of their issued invoices to the Tax Authority.

SAF-T (PT) (Standard Audit File for Tax Purposes – Portuguese version) is a standardized file (in XML format) designed to allow easy export, at any time, of a predefined set of accounting and invoicing records or equivalents, in a readable and common format, regardless of the program used, without affecting the internal structure of the program's database or its functionality. The adoption of this model provides companies with a tool that meets the requirements for obtaining information from inspection services, simplifying procedures and promoting the use of new technologies. The generation of the file by information systems always covers a certain annual tax period, totally or partially, from the beginning of that period until its end or the generation date if earlier, with the existence of functionalities that allow the user to choose documents, series or type of documents to export to SAF-T (PT) being prohibited.

You can communicate your invoicing using iGEST in the following ways:

1) Automatic communication via Webservice: To communicate automatically, you must create a sub-user in the TA. By accessing 'Entity' > 'Configure' > 'E-Invoice', check the Manual to follow all the steps in creating the sub-user.

2) Sending the SAF-T (PT) file by email: You can also configure it to be sent automatically to your email (or another email, for example, your accountant's), defining the day and time you want to receive it. Then, the file should be forwarded to the TA.

3) Export the SAF-T (PT) file directly on the platform: The user can generate/extract the SAF-T (PT) file autonomously in 'Reports' > SAF-T (PT)' > 'Invoicing Documents'. After saving the document, you should enter the E-Invoice portal and proceed with its submission.

The ATCUD is mandatory in Portugal and makes it possible to unequivocally identify each tax document issued, attesting to its integrity and security in the electronic invoicing process. With this code, it is possible to avoid the issuance of duplicate tax documents, which is essential for the organisation and financial management of a business.

It is also an important inspection tool, as it allows tax documents to be easily found in accounting and inspection systems.In fact, the ATCUD code guarantees the reliability of the data in Electronic Invoicing, as it avoids errors and fraud.

Invoice Series refer to a common practice in accounting and financial management, where invoices issued by a company are organized in numbered or alphanumeric series to track and record sales transactions.

Invoice Series are important for organization, control, and fiscal uniformity.

Yes, if you have a turnover in the previous tax period exceeding €100,000, you are required to communicate all elements of transport documents to the TA. However, transport documents where the recipient or purchaser is an end consumer are excluded.

The lack or delay in communicating your transport documents is punishable by fines ranging from 150€ to 3,750€, as defined in Article 117 of the RGIT.

iGEST helps you submit the computer file to the Tax Authority, in xml or csv format, as required by TA standards (for further clarification, consult the iGEST support manuals, available after authentication on the platform, or contact Customer Support).

Yes, we offer support for all legal and functional requirements associated with the new Cash VAT regime.

For more information, contact our support services (707 451 451 | apoio@igest.pt).

Economic agents are required to communicate the following elements to the TA:

- Tax identification number of the issuer;

- Invoice number;

- Date of issuance;

- Type of document;

- Tax identification number of the buyer who is a VAT taxpayer, when entered at time of issuance;

- Tax identification number of the buyer who is not a VAT taxpayer, when they request its entry at time of issuance;

- Taxable value of the service provision or goods transfer;

- Applicable rates;

- Reason for non-application of tax, if applicable;

- Amount of VAT charged.

A SAF-T (PT) file contains all the information of your invoicing elements. If you choose to communicate via this method, you need to go to the Finance Portal every month to manually submit the file if you have issued invoices.

The unique document code (ATCUD) allows the unique identification of a document, regardless of its issuer, type of document, and series used. The ATCUD, as defined in Article 3 of Ordinance No. 195/2020, of August 13, results from the concatenation of the validation code assigned to the series with the sequential number of the document within that series.

ATCUD can be obtained manually through the Finance Portal or automatically with Invoicing Software, such as iGEST.

It is possible to communicate series to the Tax Authority manually on the Finance Portal or via e-invoice webservice.

Transport documents must necessarily contain the following elements:

- Name, firm, or social denomination of the sender of the goods;

- Domicile or headquarters of the sender of the goods;

- Tax identification number of the sender of the goods;

- Name, firm, or social denomination of the buyer of the goods;

- Social denomination of the buyer of the goods;

- Address of the buyer of the goods;

- Tax identification number of the recipient (when they are a VAT taxpayer);

- Commercial designation of the goods (with indication of quantities);

- Loading and unloading locations;

- Date and time of the start of transport.

Note: Mobility to date does not respect this element

Transport documents issued on paper must still contain identifying elements of the typography (social denomination, headquarters, and tax identification number) and numbering.

The communication of inventories to the Tax and Customs Authority (AT) is mandatory for all IRS or IRC taxpayers, regardless of turnover, except those covered by the simplified regime.

In this sense, entities that cumulatively meet the following conditions are required to communicate inventories:

- Have headquarters, permanent establishment, or tax domicile in Portuguese territory;

- Have organized accounting;

- Are not covered by the simplified taxation regime.

If a company that meets these requirements has no stock to declare at the end of the tax period, it is not exempted from this obligation and must report the absence of stock to the TA on the e-Fatura portal.

The communication must be made by electronic transmission of data, in a file whose characteristics are defined in Ordinance 2/2015 of 6 January, without taking into account the modifications introduced by Ordinance 126/2019 of 2 May (Ordinance 66/2019-XXII-SEAF of 13 December).

The Cash VAT Regime, approved by Decree-Law No. 71/2013, is a simplified and optional taxation regime for all VAT taxpayers who have not reached, in the previous calendar year, a turnover, for VAT purposes, exceeding 500,000€ and who meet a set of other additional requirements.

*Maximum price per minute: 0,09€ (+VAT) for calls originating from fixed networks and 0,13€ (+VAT) for calls originating from mobile networks.

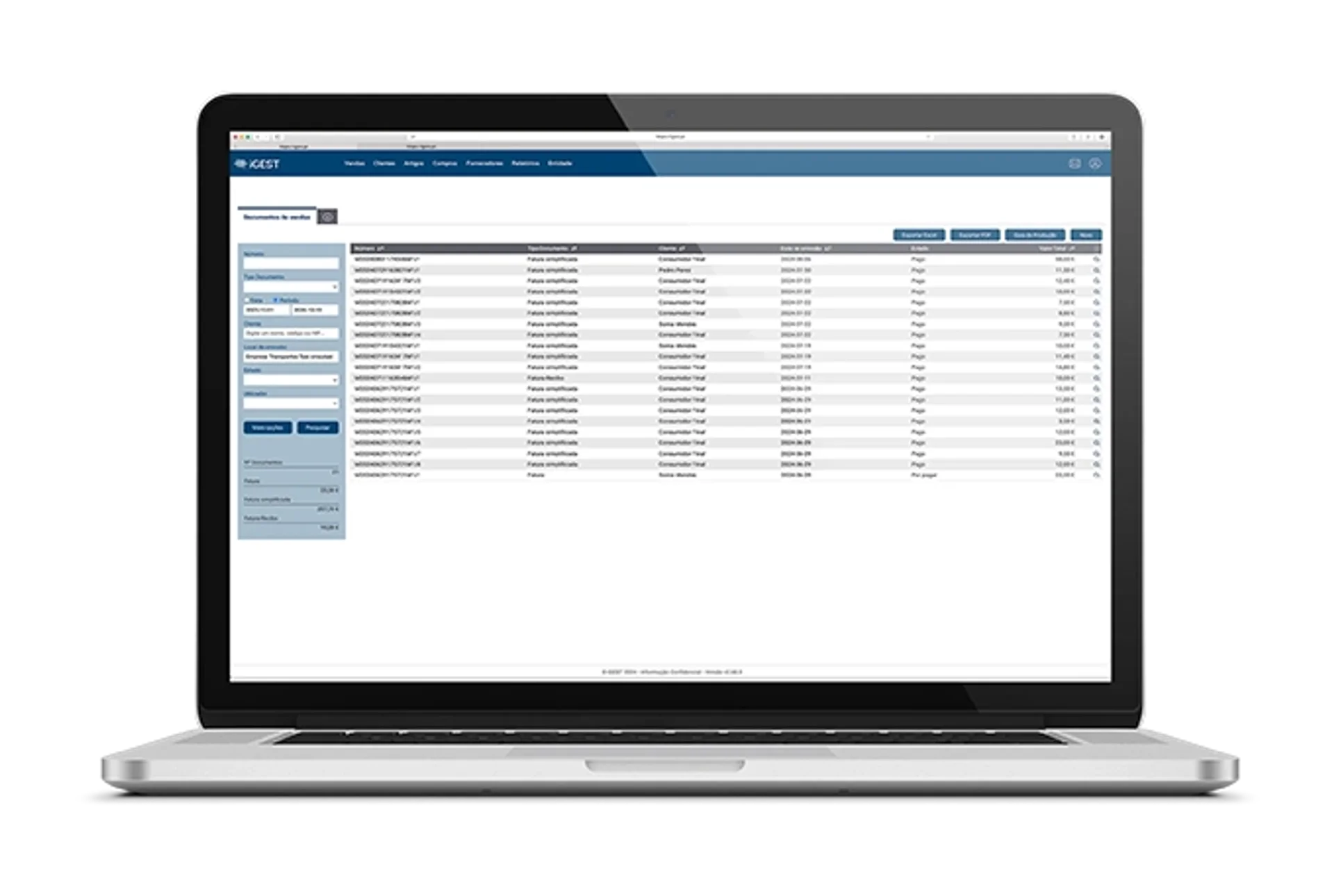

iGEST is an intuitive Invoicing Software that allows you to quickly and efficiently manage all the daily commercial and invoicing activities of a company. Our software allows you to issue invoices, receipts and delivery notes, as well as manage your stocks, warehouses, customers, purchases and sales. Enjoy it for free during 30 days!